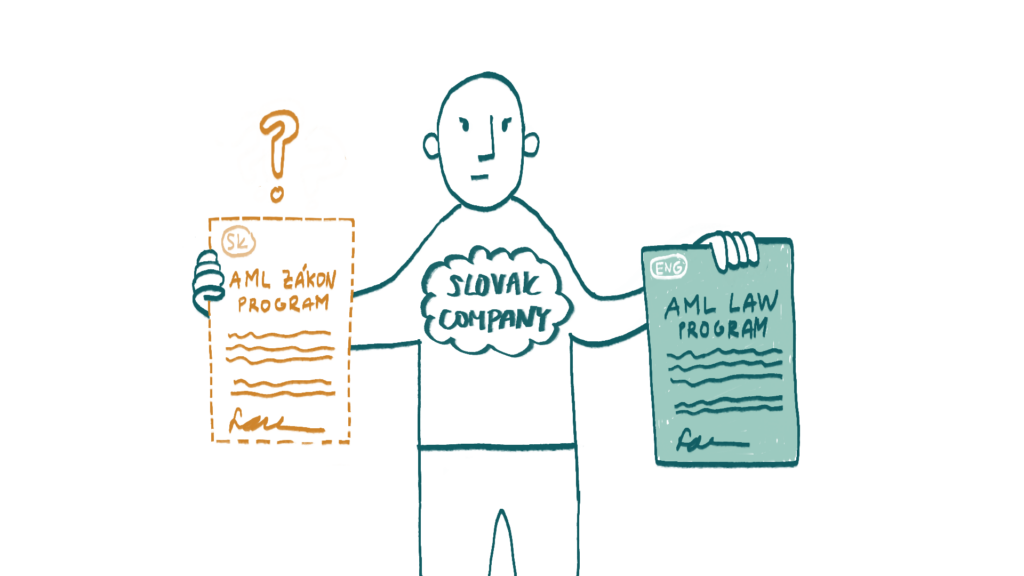

We are a branch of a foreign securities trader licensed in one of the EU states. We provide investment services in Slovakia based on the so-called single European passport. Our company, or rather the founding organisation of our branch, has developed an AML programme describing how the company and all its branches proceed in preventing money laundering and terrorist financing. This AML programme, which is written in English, is also followed by our branch. Since regulations in this area are unified across the EU and are based on EU AML directives, we assume it is sufficient for our branch to follow the AML programme developed by our founding organisation, and it is not necessary to create a separate AML programme specifically for our branch. Recently, however, the National Bank of Slovakia requested us to submit the AML programme of our branch in the Slovak language. Are we required to have an AML programme in Slovak?

Section 20 of Slovak Act No. 297/2008 Coll. on the Protection Against Legalization of Proceeds from Criminal Activity and on the Protection Against the Financing of Terrorism (AML Act, where AML stands for Anti-Money Laundering) stipulates that each obliged entity must develop an AML programme reflecting its organizational structure, size, and nature of business. This section also specifies the content requirements for the AML programme. In addition to the AML programme, an obliged entity must identify, assess, evaluate, and update the risks of money laundering and terrorist financing according to the types of transactions and business relationships, reflecting its own risk factors and those listed in Annex No. 2 of the AML Act.

According to Section 5(1)(b)(5) of the AML Act, a securities trader is considered an obliged entity. According to Section 5(2) of the same provision, an obliged entity is also a branch, organizational unit, or operation of a foreign legal entity specified in Section 5(1), including any representation of a foreign financial institution operating in the Slovak Republic.

All obliged entities (including branches of foreign securities traders) are required by Section 20(1) of the AML Act to “develop and update a written programme of their activities aimed at preventing money laundering and terrorist financing (hereinafter referred to as ‘the programme’) in the state language, reflecting their own organizational structure, size, and nature of business, so that its content and focus enable the obliged entity and its employees to fulfil their obligations aimed at preventing money laundering and terrorist financing under this Act.”

This means that your branch must have its own specific AML programme reflecting the organizational structure, size, and nature of the activities of your branch. This programme must be in Slovak and should include specific procedures and principles that your branch will follow in preventing money laundering and terrorist financing. The AML programme should include, in particular, procedures for identifying and verifying the identification of your clients, evaluating and investigating unusual business transactions of your clients, categorizing your clients based on their risk, as well as procedures for reporting unusual transactions to the Financial Intelligence Unit (FIU) of the Slovak Ministry of Interior. The programme should also designate a specific person in your branch responsible for AML tasks and contact with the FIU, as well as a training schedule for employees of the Slovak branch. Simply put, the local AML programme should be sufficiently specific to guide the employees of your branch and clearly outline their powers and responsibilities in identifying clients, as well as identifying, retaining, and reporting unusual transactions. The AML programme typically includes risk assessment, which should be proportionate to the nature and size of the obliged entity and must take into account the results of the national risk assessment prepared by the FIU of the Slovak Ministry of Interior under Section 26a(1).

It is possible that the AML programme your company uses for all its branches is sufficiently specific and reflects the organizational structure, size, and nature of each individual branch, as well as local specifics arising from the regulations of each European country where your company operates through its branches (e.g., the obligation to report unusual transactions to local FIUs, specific contact information required for reporting, etc.). It is also possible that you have conducted a risk assessment considering the circumstances of your branch operating in Slovakia. This may be the case, but in any case, the programme must be in Slovak according to the Slovak AML Act, and the National Bank of Slovakia, as well as the FIU of the Slovak Ministry of Interior, have the right to request its submission and review whether such a programme meets the requirements of the Slovak AML Act.

We recommend that you first translate your existing AML programme into Slovak, but then also review this AML programme from the perspective of the requirements it must meet under the Slovak AML Act.