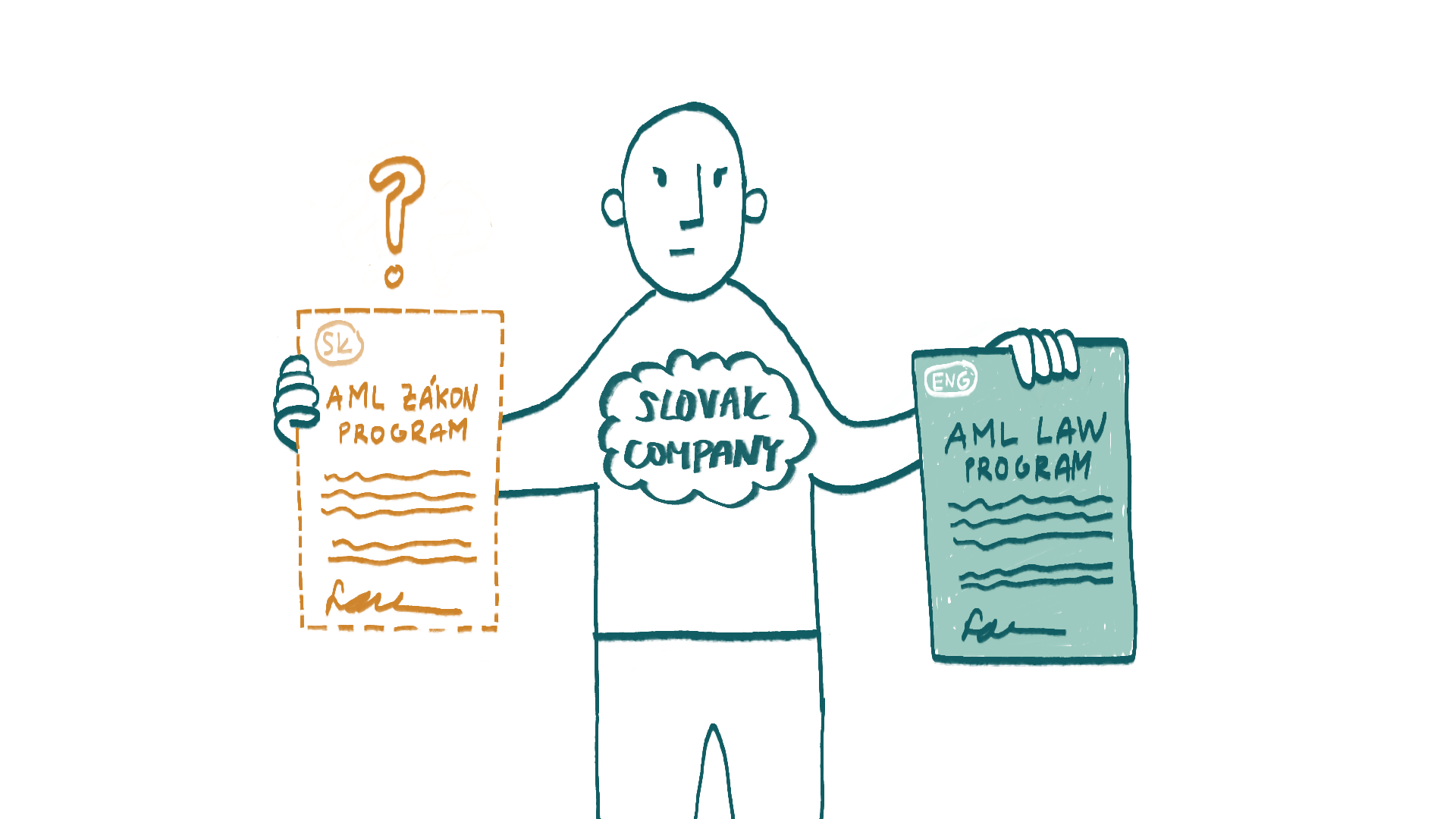

We are an asset management company operating under the Slovak Act on Collective Investment. Our sister company in the Czech Republic has been required to comply with the new Czech Whistleblower Protection Act since August 1, 2023. This is an obligation arising from the amended Czech AML Act, according to which all obliged entities under the AML Act must also fulfil the obligations under the new Czech Whistleblower Protection Act. We understand that this requirement stems from a European directive and should be similar in Slovakia. However, we could not find any information about whistleblowing in the Slovak AML Act. Therefore, we are uncertain whether we, as a Slovak fund management company, need to have an internal whistleblowing system in place and fulfil related obligations. If so, from what date does this obligation apply, and can we adopt and follow the Czech internal regulation as a group directive?

The legal framework for whistleblower protection in Slovakia was established in 2019 with Act No. 54/2019 Coll. on the Protection of Whistleblowers. This act created the Office for the Protection of Whistleblowers and introduced obligations for employers with 50 or more employees and public authorities with 5 or more employees. If your asset management company employs more than 50 employees, you should have implemented the necessary measures according to the Slovak law back in 2019.

However, the Slovak legislation was not entirely compatible with the European Directive on Whistleblowing (Directive (EU) 2019/1937). The directive, for example, defined a broader range of obliged entities than the Slovak law. In May of this year, an amendment to Act No. 54/2019 was passed, which, among other things, expanded the scope of obliged entities. In Slovakia, the scope of obliged entities is not identical to that under the AML Act, as it is in the Czech Republic. The amendment to the Slovak Whistleblower Protection Act expanded the scope of obliged entities to include employers providing financial services, transport safety services, and environmental services, regardless of the number of employees.

Employers providing financial services who have not yet complied with the obligations under the Slovak Whistleblower Protection Act should start doing so from September 1, 2023. They should, for example, adopt an internal whistleblowing policy, appoint a whistleblowing officer, maintain a record of reports, and take measures to protect whistleblowers and ensure confidentiality.

The amendment to the Slovak Whistleblower Protection Act does not define which entities are considered providers of financial services, nor can this be directly inferred from the European directive, under which the Slovak law extends the obligation to financial service providers. However, the definition of financial service providers can be found in the Slovak legal framework, specifically in Act No. 266/2005 Coll. on Consumer Protection in Remotely Provided Financial Services. According to this act, an asset management company established under the Act on Collective Investment is considered a provider of financial services. Although this definition is intended for the purposes of Act No. 266/2005, we believe it should be used to interpret the term financial service provider in the absence of other regulations.

As an asset management company, you should comply with the obligations under Act No. 54/2019 Coll. on the Protection of Whistleblowers from September 1, 2023, and other financial service providers should do the same. These include banks, securities traders, insurance companies, pension fund management companies, supplementary pension companies, electronic money institutions, consumer credit providers, and other entities with similar activities, such as payment institutions, limited-scope payment service providers, and other entities under the supervision of the National Bank of Slovakia.

Regarding adopting the Czech internal regulation as an internal regulation of the Slovak company, we believe that within intra-group procedures, you can unify processes, but the internal regulation should be adopted separately by the Slovak company. It should be tailored to the Slovak law, adhere to its terminology, and comply with the obligations arising from the Slovak act. Even though the obligations are very similar, the obligations under the Slovak act are somewhat narrower than those under the Czech act. However, we believe it is not appropriate to simply adopt the Czech internal regulation and present it as Slovak without further modifications. The person responsible for this area in your company should compare the Czech regulation with Slovak legislation and adapt the guideline for the Slovak company. Such “localization” can also be outsourced.

As we have mentioned, the regulator for this area is the Office for the Protection of Whistleblowers, which has so far not imposed fines and has focused mainly on raising awareness. We anticipate that after expanding obligations to new entities, this trend may continue for a while. However, we believe it may change next year.

We appreciate the user-friendliness of the Office for the Protection of Whistleblowers’ website, and the FAQ section seems quite helpful: https://www.oznamovatelia.sk/najcastejsie-otazky/.