My brother is having trouble repaying his loan. In fact, he has problems with his overall ability to manage his finances. He tends to take out more loans than he can pay back, he trusts various friends who convince him to lend them money, and he is willing to go into more debt even though he is having trouble paying back the loans he has. When my parents’ estate was settled, we agreed that the apartment would go to my brother. However, my brother established a mortgage on this apartment to secure his loans. Since he was not repaying the loans, we agreed that the apartment would be transferred into my ownership, and I would establish a lifelong right of use as an encumbrance on the apartment in his favour. The land registry approved the transfer of the apartment, but the banks objected to the transfer of ownership of the apartment encumbered by the mortgage, claiming that my brother had violated the agreement. They also oppose the registration of the encumbrance, which has not yet been recorded. The banks threaten early repayment of the loan and enforcement of the mortgage, as my brother is not repaying the loans. I was afraid of losing the apartment, so I started repaying the loans. Nevertheless, according to the banks, my brother is still in breach of the loan agreement, and I am afraid they may start enforcing the mortgage. What should I do? Is it enough to continue repaying the loans? Do I need to inform the bank that I am repaying the loans? And wouldn’t it be better for my brother to declare personal bankruptcy, thereby clearing his debts?

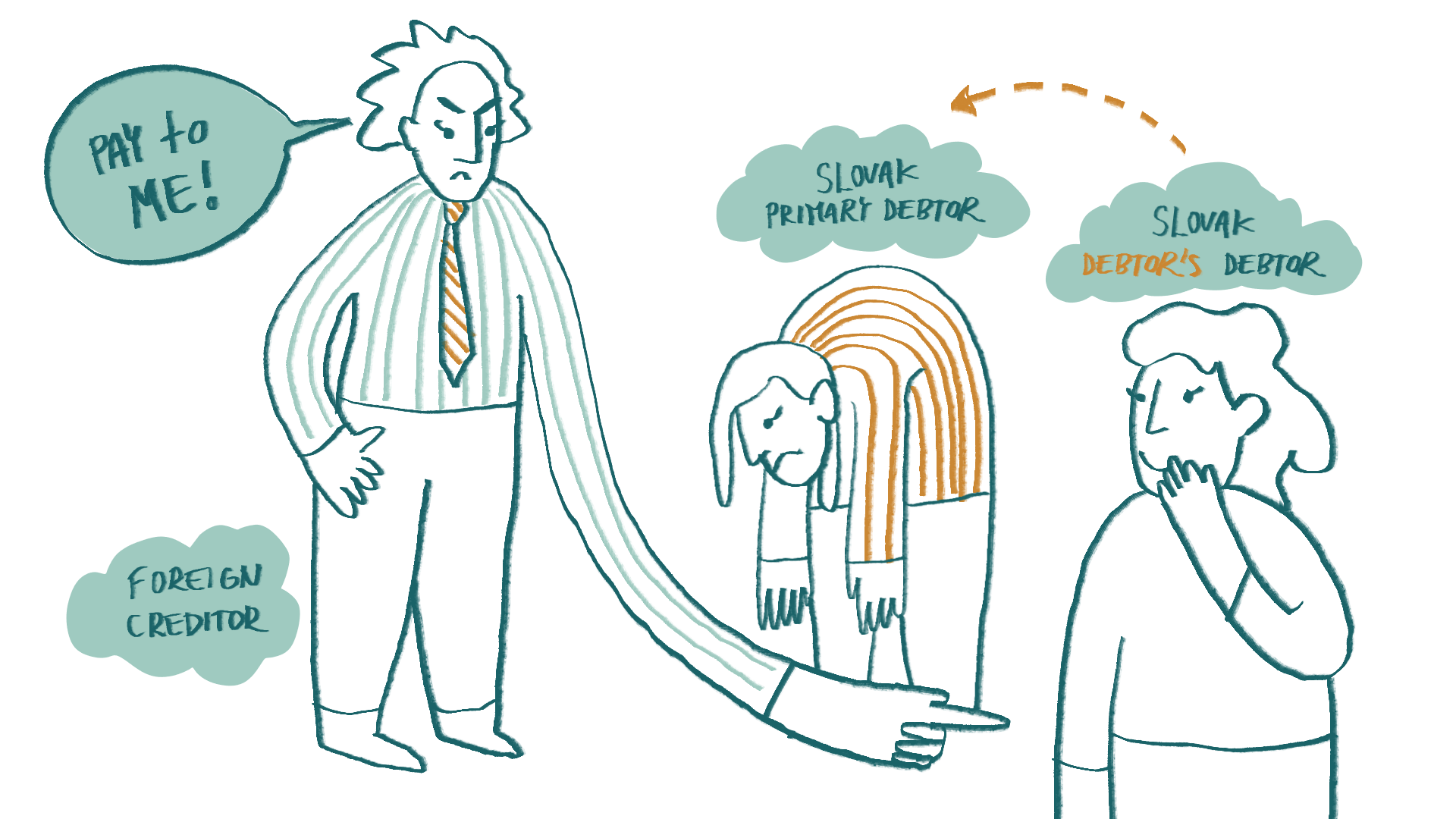

We understand that you wanted to prevent the forced sale of your parent’s apartment in foreclosure of the lien. However, the transfer of the encumbered apartment without the bank’s consent constitutes a violation of the loan agreement. According to the loan terms and conditions of all banks, the debtor or any other person providing security for the loan is always required to obtain consent for the transfer of the collateral from the bank in advance. Despite the fact that the transfer of the collateral results in the transfer of the mortgage to the new owner of the collateral, consent to the transfer of the encumbered property is required under the contractual terms and conditions of the banks. This is because, according to Section 151(h) of the Slovak Civil Code, the mortgage not only affects the acquirer of the real estate, but also transfers to them all rights and obligations from the mortgage contract. However, banks need to know who their contractual partner is, with whom they should communicate, and also the reason for the transfer of the collateral.

Your case, where the transfer of the property occurred because you were afraid that your brother would lose the apartment due to non-repayment of the loan, and then you started repaying the loan on his behalf, is a typical example of when it would be better to inform the bank about this situation and request its consent to the transfer of the apartment, and to agree with it on further steps. If the transfer of the encumbered property occurred without the bank’s consent and, in addition, the encumbrance was also established, this constitutes a breach of obligations under the loan agreement. In the event of a breach of obligations under the loan agreement, the bank has the right to declare the loan due for immediate repayment. This means that the agreed repayment terms are no longer valid, and the entire loan must be repaid at once. Declaration of early repayment usually leads to enforcement of the mortgage, as the ordinary debtor does not have the means to repay the entire loan.

The enforcement of the mortgage on the apartment, which originally belonged to your parents, is exactly what you wanted to avoid. You started repaying your brother’s loans to prevent losing the apartment due to enforcement of the mortgage. If you do not want to lose the apartment, we recommend that you continue to repay the loans. However, we recommend that you agree with the bank on joining the obligation, in this case, your brother’s obligation to repay the loans. Joining the obligation is usually done by a simple written agreement between you as the joining debtor and the bank as the creditor, under which you become the debtor of your brother’s loans alongside him. The consent of your brother, as the original debtor, to your joining the obligation is not required. This will allow the bank to communicate directly with you and provide all information about the loan relationship to you, which it could not do before due to banking secrecy.

Furthermore, we recommend that you refrain from establishing the encumbrance in favour of your brother. Simply withdraw the proposal for the encumbrance deposit and cancel the encumbrance agreement by agreement between you and your brother. By doing this, you will rectify the breach of contractual and legal obligations that occurred by concluding the encumbrance agreement. According to Section 151i of the Slovak Civil Code, the pledgee is obliged to refrain from anything that reduces the value of the pledge (except normal wear and tear), and according to Section 39 of the Slovak Civil Code, a legal act that contradicts the law in its content or purpose is invalid. Establishing an encumbrance consisting of the right of lifelong use of the real estate by a third party undoubtedly reduces the value of the pledge. From our point of view, establishing an encumbrance by the pledgor is an absolutely invalid legal act, and the land registry should not approve the deposit of the encumbrance, especially if the bank objects to it. Even if the land registry were to approve the deposit of the encumbrance, the bank would most likely later achieved its deletion, either due to its absolute invalidity or due to the contestability of this act.

If your brother has multiple loans and at least one execution proceeding that has been ongoing for more than a year, personal bankruptcy, known as debt relief for individuals, is indeed an option to consider. However, personal bankruptcy does not address the potential loss of real estate. If your brother were to initiate debt relief proceedings, the banks would register their loans as their claims, and since the claims are secured by a mortgage, they could be satisfied from the sale of the collateral, i.e., the real estate. Even if you were already the owner of the collateral at the time of bankruptcy, the banks would still have the right to satisfy themselves from the sale of your apartment, as it would still be encumbered by the mortgage. Contractual mortgage rights are not extinguished by declaring bankruptcy, unlike execution mortgage rights. If you want to preserve your ownership of the apartment, you would have to pay off your brother’s debts even within his personal bankruptcy.