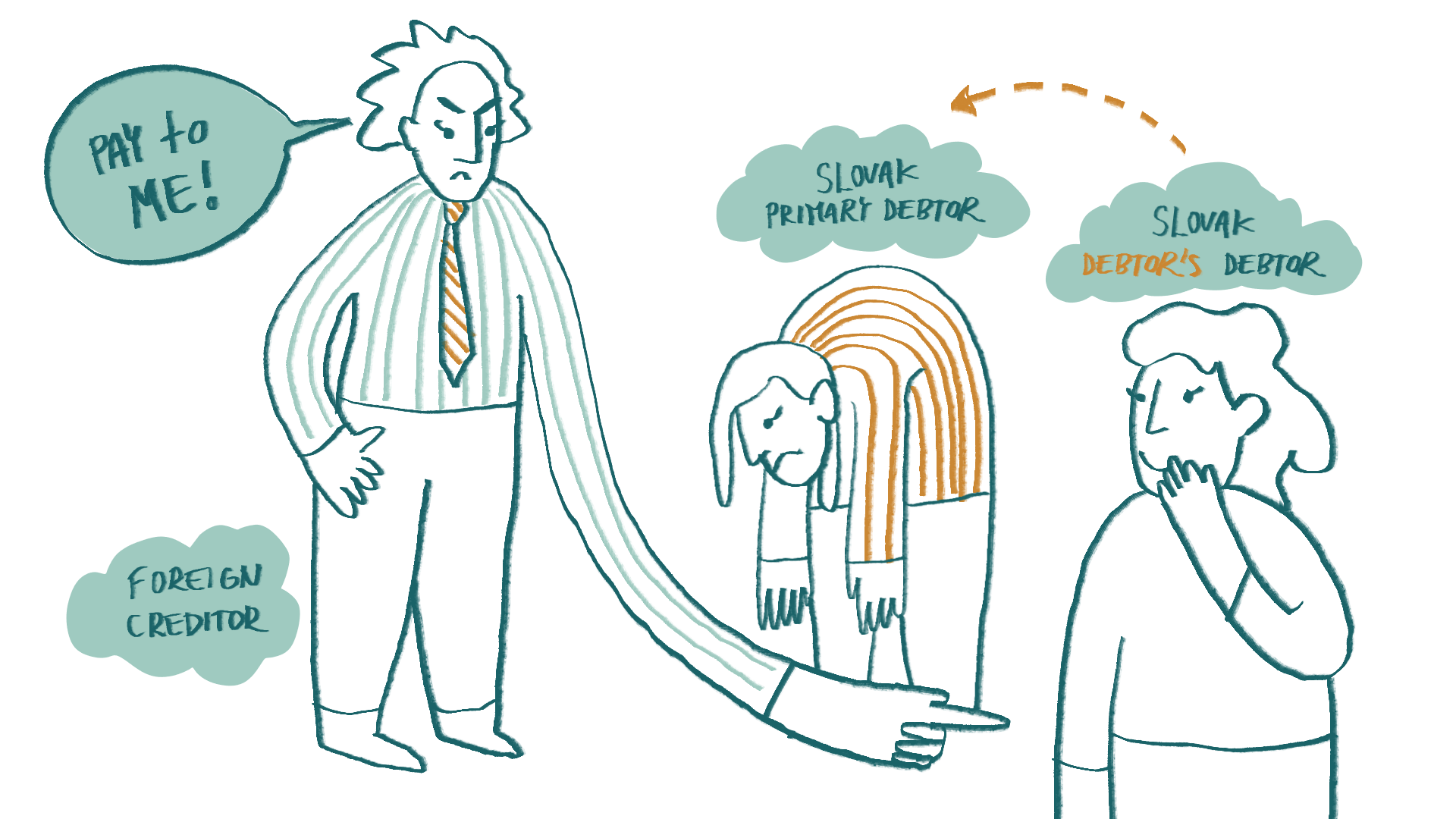

An employee asked us to send his salary to a bank account held in a Czech bank. While this is an account in euros, it is not an account held by a Slovak bank or a Slovak branch of a foreign bank. We responded to the employee that although we would like to accommodate his request, we cannot comply as it contradicts the provision of section 130 subsection 8 of the Labor Code. This provision explicitly states that an employer is obliged to transfer wages to an account specified by the employee in a bank or a branch of a foreign bank in Slovakia. The employee claims that our view is incorrect because he explicitly requested it and if we agree, contractual freedom prevails. Is our opinion correct and can we indeed not pay the employee’s salary into an account held at a bank outside Slovakia despite his explicit request?

According to section 130 subsection 8 of the Labor Code, it is indeed stipulated that an employer must transfer the wage or part thereof to an account specified by the employee in a bank or a branch of a foreign bank in Slovakia. This provision is not formulated dispositively, i.e., it explicitly does not imply that the contractual parties can deviate from it or agree differently. At first glance, it seems that your view is correct – according to the Labor Code, wages cannot be transferred to any other bank account than one held in Slovakia.

However, upon deeper reflection, this makes no sense. Why should the Labor Code restrict parties to the employment agreement in such a matter if their will is the same? Transferring wages to a bank account held in another EU member state poses no risk to either the employee or the employer. Since the introduction of SEPA (Single European Payment Area) payments, funds are credited to an account in a bank held in Slovakia at the same time as they are credited to an account in a bank in one of the SEPA countries. Bank fees for SEPA payments are minimal (usually 0.20 EUR). Moreover, if an employer wants to accommodate an employee, it is up to them whether they decide to pay any fee for the transfer to an account held in a bank outside Slovakia.

If we were really to interpret the Labor Code such that section 130 subsection 8 does not provide the possibility to deviate from the obligation to transfer wages to an account held in a bank or a branch of a foreign bank in Slovakia, even when both the employee and employer agree to it, it would mean that the employer could not transfer the employee’s wages even to a payment account. A payment account, according to Act No. 492/2009 Coll. on payment services, is any current account or other account held by a payment service provider. Payment service providers can also be institutions other than banks, especially payment institutions. In our opinion, the Labor Code should not be interpreted as meaning that wages cannot be transferred to a payment account held by a provider other than a bank. This would be an unfounded restriction on payment institutions, which are similarly regulated financial institutions as banks.

We think that in this case, it is necessary to adhere to the provision of section 1 subsection 6 of the Labor Code, according to which: “In employment relations, the conditions of employment and working conditions of an employee can be arranged more favorably than this law or other labor law regulation stipulates, unless this law or other labor law regulation explicitly prohibits it or if the nature of its provisions implies that they cannot be deviated from.” Although the nature of the majority of provisions of the Labor Code is mandatory (thus no other arrangement can be used even when the parties agree), the primary goal of this mandatory arrangement is the protection of employees. However, labor law still falls under private law, where the constitutional rule of contractual freedom, expressed by the principle “everything that is not forbidden is allowed,” applies. However, in labor law, this principle is modified so that everything that benefits the employee and is not prohibited is allowed.

Our conclusion, therefore, is that at the request of the employee, you can transfer his wages to an account held in a bank or a branch of a foreign bank outside of Slovakia. And at the employee’s request of, you can also transfer wages to an account held by a payment institution. However, it is not your obligation, because the Labor Code only obliges you to transfer wages to a bank account held by a Slovak bank or a Slovak branch of a foreign bank. But if you want to accommodate the employee, we see no problem in doing so.