We are an international investment company with a branch in Slovakia authorized to provide certain investment services. We have a similar branch in the Czech Republic where we offer the so called “long-term investment product (DIP)” to our clients. We plan to introduce a similar version of this product in Slovakia. We know that Slovakia has also implemented a tax-advantaged long-term investment savings (DIS) plan. We assume that since we can offer DIP in the Czech Republic, we can offer DIS in Slovakia under similar conditions. As a licensed investment company, we believe that the first step is to register on the list of long-term investment savings providers, likely maintained by the National Bank of Slovakia. Subsequently, we should be able to conclude long-term investment savings agreements with clients, under which we can include specific financial instruments in the client’s long-term investment savings. Clients should then be able to take advantage of various tax benefits under Slovak regulations. Is our assumption correct?

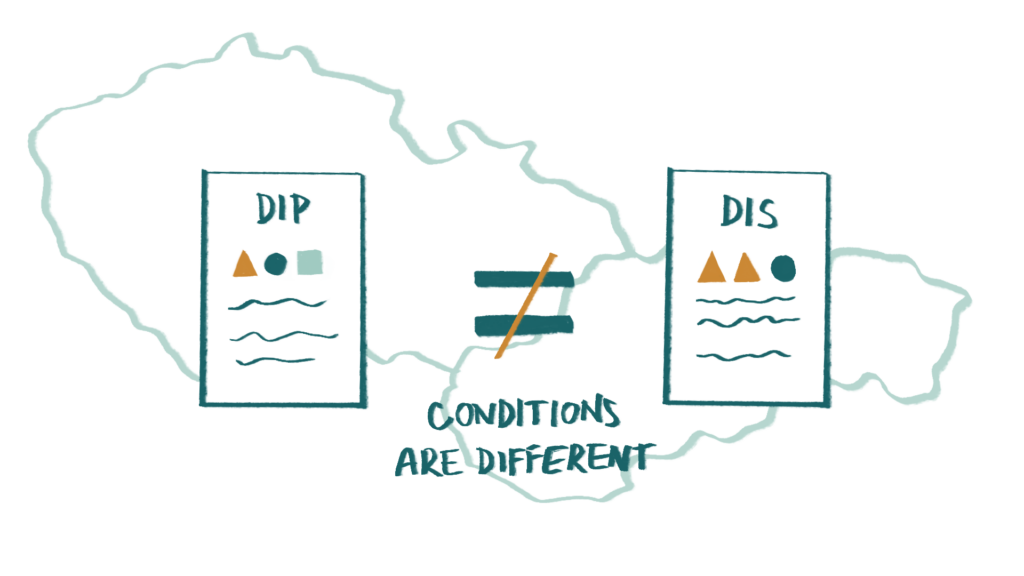

While both the Czech Republic and Slovakia introduced long-term investment product/savings with the objective of supporting long-term financial stability and increasing retirement savings, the specific conditions of these products differ significantly. There are various differences between the Czech long-term investment product (DIP) and the Slovak long-term investment savings (DIS) in terms of who can provide these products, how they can be provided, and the conditions for tax advantages.

Firstly, in the Czech Republic, DIP can be provided by specifically listed financial institutions – banks, savings banks, credit unions, securities dealers, investment companies, self-managed investment funds, and similar international institutions authorized to provide services in the Czech Republic, regardless of their license scope. In Slovakia, DIS can be provided by securities dealers and other financial institutions authorized to offer specific investment services: portfolio management and execution of client orders on their account. This means that even if you meet the conditions to offer DIP in the Czech Republic simply because you are a licensed investment company, you may not necessarily meet the conditions in Slovakia unless you have the authorization to provide the portfolio management service or the client order execution service.

Regarding the assumption for starting to offer long-term investment savings in Slovakia, you need a license to provide both, portfolio management services and client order execution services. You do not need to notify the National Bank of Slovakia, as it does not maintain a list of DIS providers, unlike the Czech National Bank, which does.

The requirement to offer DIS in Slovakia does not include signing a specific long-term investment savings agreement, unlike in the Czech Republic, where such an agreement is required under Act No. 256/2004 Coll. on Business Activities on the Capital Market. Slovak Act No. 566/2001 Coll. on Securities and Investment Services does not restrict DIS providers regarding the assets forming the long-term investment savings, unlike the Czech law, which specifies the assets that can be included in a DIP.

There are also differences in tax support, which is a core aspect of these products. In the Czech Republic, DIP is included among other “retirement savings products” and benefits from: i) employer contributions up to CZK 50,000 annually exempt from income tax, ii) a tax deduction of up to CZK 48,000 annually within DIP, with a minimum duration of 10 years and withdrawal possible only after reaching the age of 60, and iii) exemption from income tax on the sale of assets included in the DIP.

In Slovakia, there are no employer contributions or the possibility of deducting a certain amount from the tax base in connection with DIS. In Slovakia, if the DIS is established for a minimum period of 15 years and no benefits were paid to the owner during this period, and the client invested a maximum of EUR 6,000 annually into the DIS portfolio, excluding reinvestments within the portfolio, the income from the sale of securities, options, and income from derivative operations arising from the long-term investment savings, including income paid after 15 years from the start of the long-term investment savings, is exempt from income tax.

In summary, the conditions for DIS in Slovakia differ from those for DIP in the Czech Republic. DIS can be provided in Slovakia only by financial institutions licensed to execute client orders and manage portfolios. Registration in a list of DIS providers is not required in Slovakia, nor is signing a specific DIS agreement. The tax advantage in Slovakia applies only to the income from specific portfolio components belonging to the DIS, as well as their sale, and there are no employer contributions or the possibility of tax base deductions.