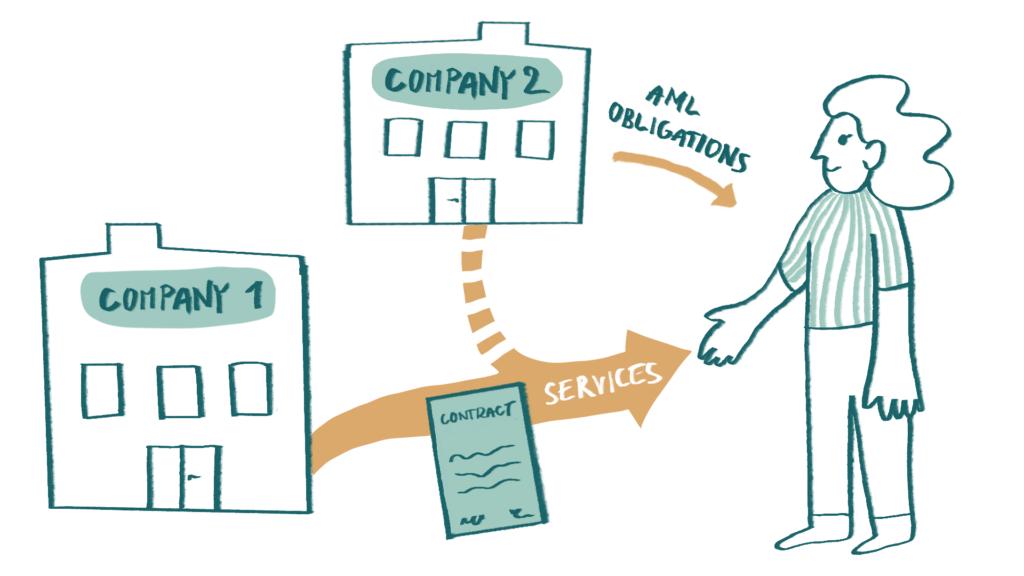

Our company is an ‘obliged entity’ under the Slovak AML Act. We provide services to clients whom we are obliged to, among other things, identify and verify identification. However, we often provide services to clients as a subcontractor, i.e. we do not have a direct contractual relationship with the client. We have a contractual relationship with the principal supplier of services to the client, and this principal supplier is usually part of the same economically and personally interconnected group as our company. What are our obligations under the Slovak AML Act, in particular in relation to identification and verification of identification in relation to an end client with whom we do not have a direct contractual relationship?

The answer to your question depends on whether, within the meaning of Act No.297/2008 Coll. on the Protection against the Legalization of Proceeds from Crime and on the Protection against the Financing of Terrorism (AML Act, AML = Anti-money Laundering), the entity receiving your services can be considered a client, even if you provide the service indirectly as a subcontractor without a direct contractual relationship.

According to the definition of the term ‘client’, which is derived from Section 9(d) of the AML Act, a client is primarily considered someone who is a contractual party with you, the obliged entity. Clearly, this is not your case. A client is also someone who participates in actions that would make them your client. This refers to pre-contractual relationships, and it is also not your case. A client can also be someone who represents the other contractual party – this is not your case either. Finally, a client is considered someone “who, based on other circumstances, is authorized to handle the subject of the contractual relationship connected with the business activity of the obliged entity.”

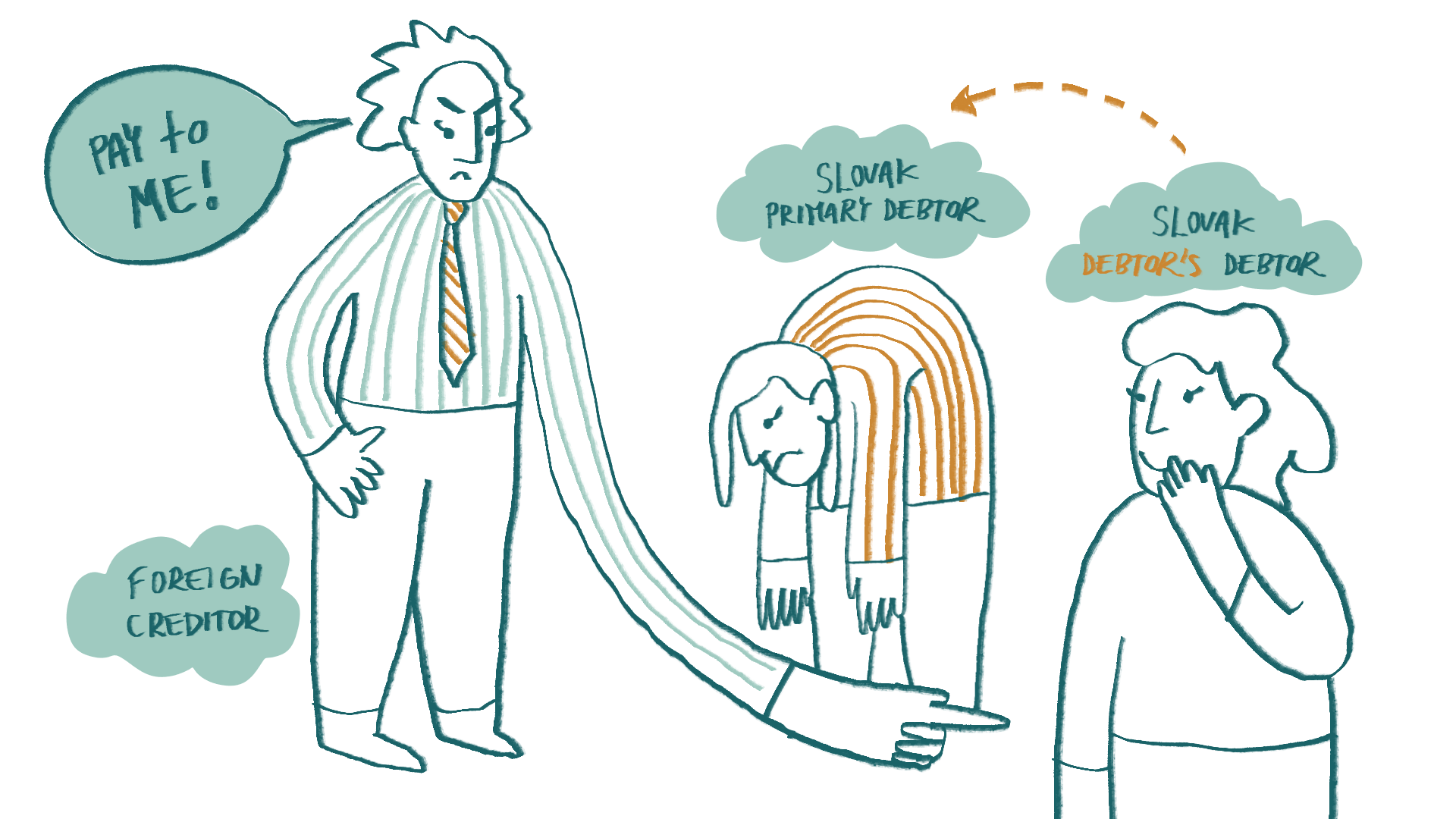

It is this fourth part of the client definition under the AML Act that we believe applies to subcontracting situations, where you provide a service to a client without a direct contractual relationship. This part of the definition is applicable if the service provision results in something that the client can handle. For example, this could involve the preparation of a report, analysis, or other output provided to the client. We believe that even if your involvement in providing transaction advisory services is only indirect, the recipient of such partial services could be considered your client, provided they receive certain summaries, overviews, or recommendations from you.

The determining factor in the fourth point of the client definition under the AML Act is the ability to “handle the subject of the contractual relationship.” This allows for identifying who will be considered a client. Therefore, if the result of your activity arises from a contractual relationship that was concluded with someone other than the person for whom the result is intended (the end client), and this end client can handle the result, then that entity is regarded as your client, and you have obligations towards them under the AML Act.

However, a legitimate question is how you can in practice request identification data from a person with whom you do not have a direct contractual relationship, or how you can fulfil your identification and identification verification obligations and other obligations under the AML Act in relation to that entity. So, under the Act, you do have the authority to identify and verify the identification of any client. However, if you do not have a direct contractual relationship and contact with the client and you only have contact with the client through, for example, another member of your group, then you should authorise another member of your group to identify and verify the identification. In essence, it is as if you are outsourcing your AML duties, which the AML Act allows.

Therefore, if you have a contract with another group member, where you commit to providing services related to the end client, it would be appropriate to include in that contract the obligation for that group member to identify the end client, verify their identification, and provide you with the results of these activities, as well as fulfil other AML-related tasks you may request. This way, you ensure compliance with your AML obligations.

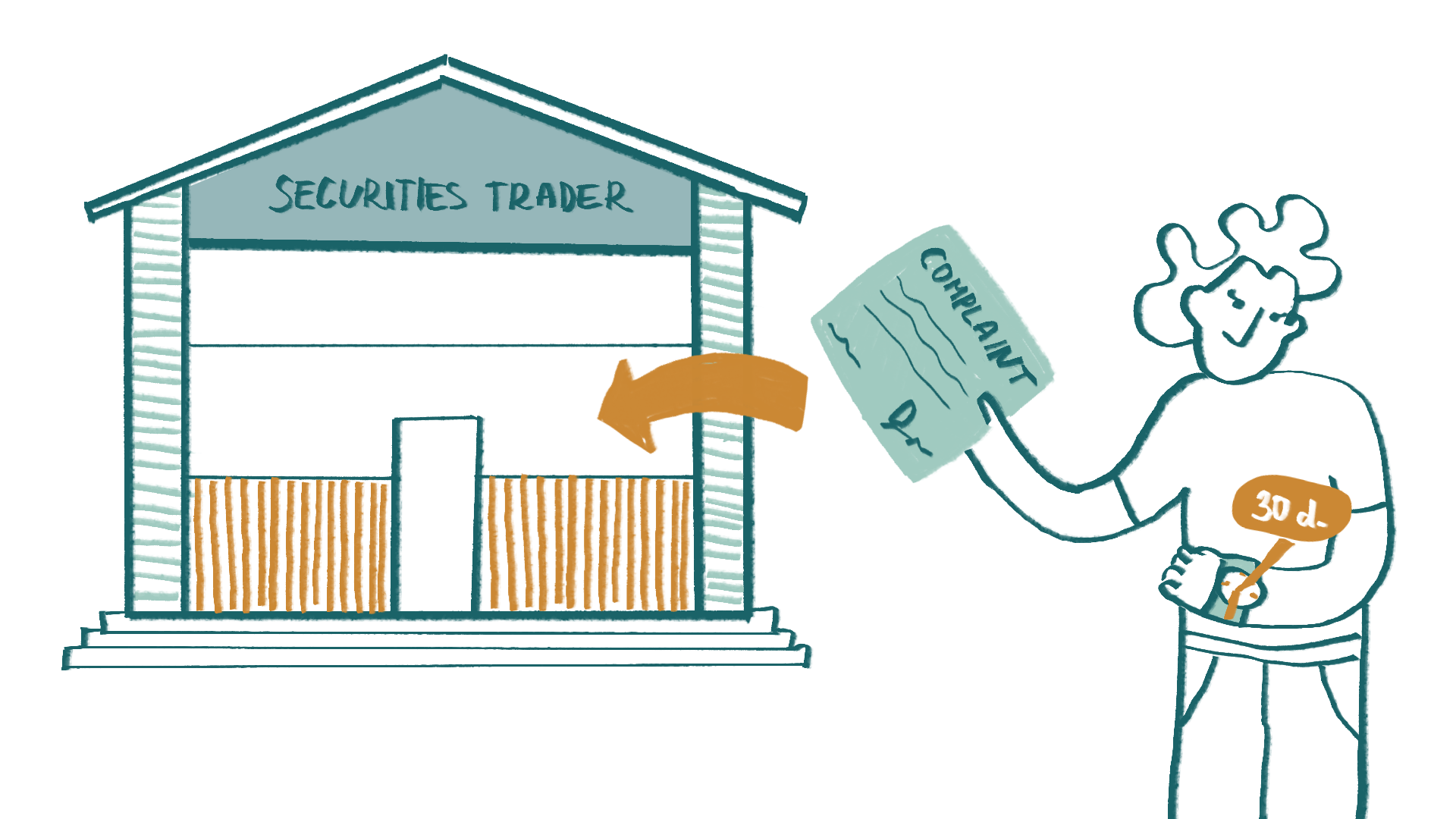

Beyond that, however, it will be your responsibility to assess the client’s operations in the same way as you would for any other client. You are the one who, in connection with work on a subcontract, may obtain information that identifies an unusual transaction. Therefore, according to the interpretation of the AML Act, you should evaluate such a client’s activities concerning unusual business transactions and report them if detected. We assume that in practice you would proceed to such reporting in cooperation with the member of your group whose direct client it is. This cooperation is generally not excluded by the AML Act; after all, it is your common client and you can, in our view, assess the unusualness of the transaction together.

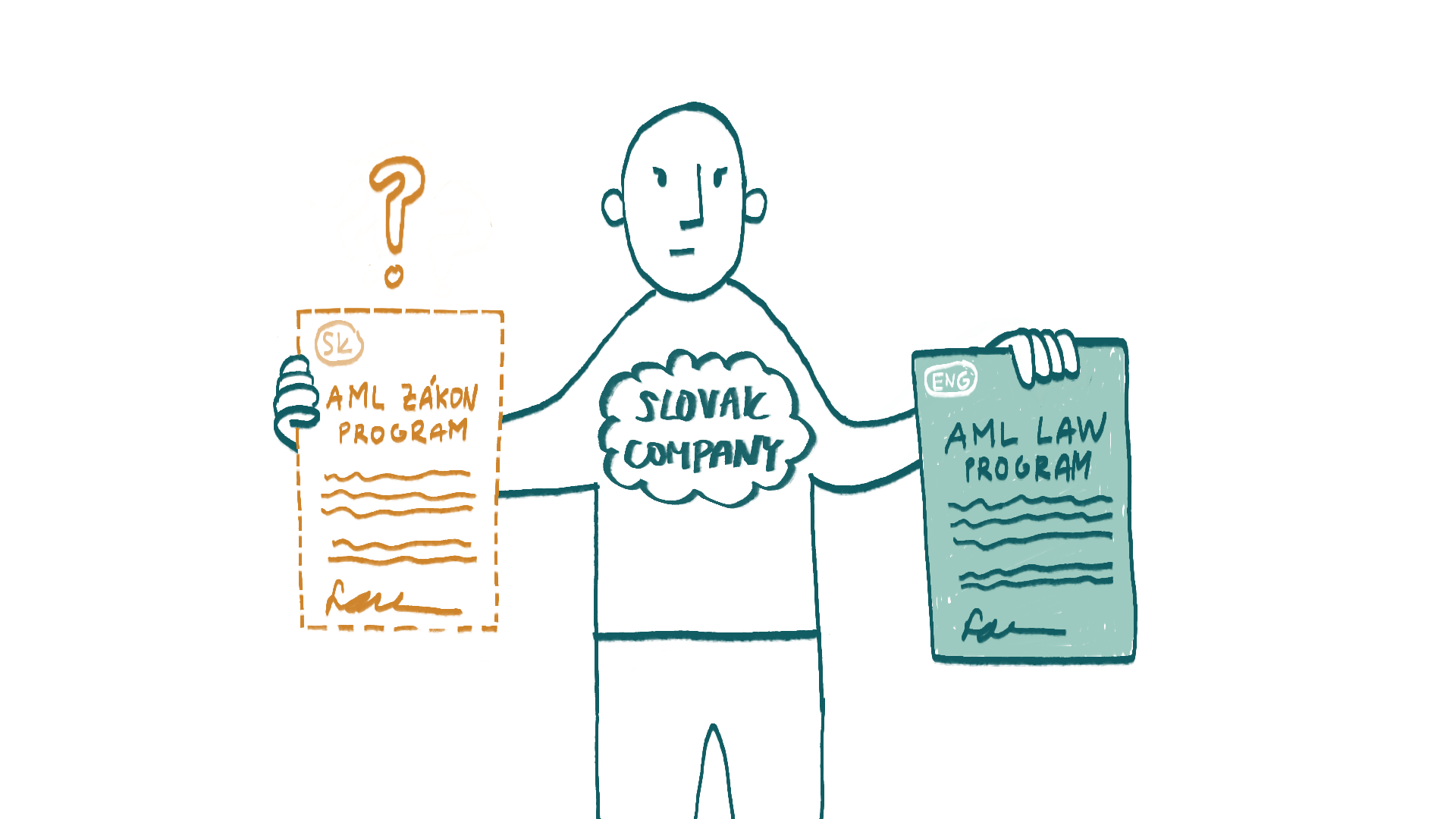

If such subcontracting collaborations occur regularly in your case, you should describe these procedures in your AML program. This ensures that the employees with responsibilities in this area know how to proceed.