Our US corporation has recently expanded by acquiring a new business that leases aircraft to aviation companies in Eastern Europe, including Slovakia. We are looking to understand the specifics involved in such leasing arrangements. This includes the requirements for lease registration, any special terms we should be aware of, US choice of law possibilities, and any stamp duties that need to be paid. Additionally, a critical aspect for us is to know the process for repossession of the aircraft by the lessor or by the mortgagor in cases of default under the Lease Agreement or the Financing Agreement. Questions like the necessity of an export license or permit, and whether Slovakia adheres to the 2001 Cape Town Convention, are particularly important for us.

In Slovakia, the validity and enforceability of an aircraft lease do not depend on specific forms, such as language requirements, notarization, or the application of an apostille. Regarding the contents of the lease, there are no mandatory special terms required. However, given the complexity of aircraft leases, it is recommended to seek legal advice from a local law firm experienced in these matters.

When it comes to the governing law of the lease, the choice of US law is generally upheld as valid in Slovakia, especially when one of the parties is not a Slovak entity. Parties have the freedom to choose applicable law, and the selection of US law is respected, provided it does not conflict with the mandatory provisions of the Slovak legal system.

There is no separate register specifically for aircraft leases in Slovakia. However, the Slovak Aircraft Register, maintained by the Slovak Transport Authority, does record details of both the owner and the operator of the aircraft. When these two entities differ, it typically indicates that the aircraft is leased. This registration provides clarity on the ownership and operational control of the aircraft.

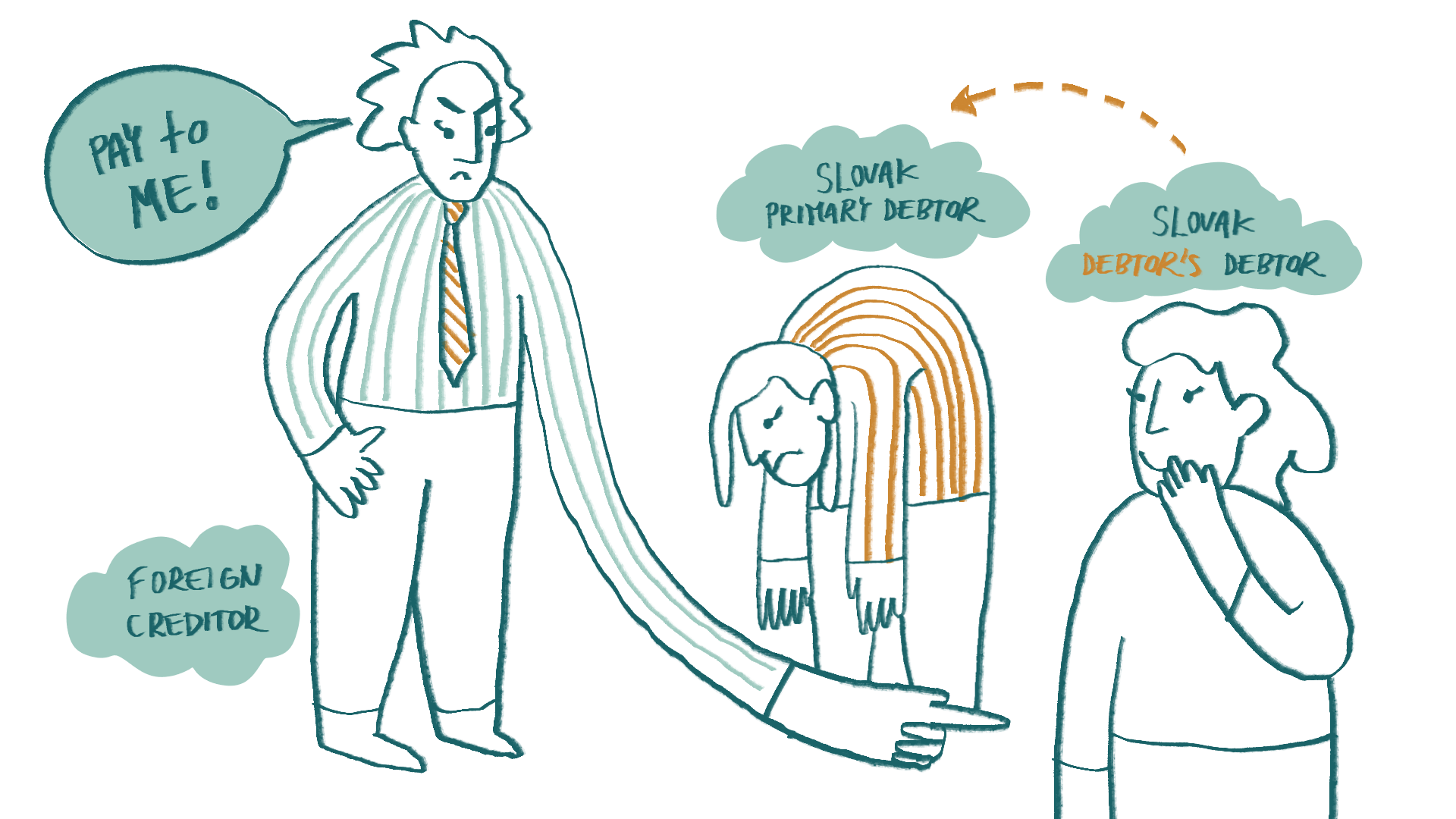

In the event of a default under the lease, if the terms allow, the owner can terminate the leasing of the aircraft and enforce the lease by taking physical possession. This option can be negotiated freely in the lease agreement.

The owner is generally entitled to take physical possession of the leased aircraft without the need for judicial proceedings in Slovakia, as long as such enforcement is stipulated in the lease agreement. However, only legal measures should be employed to this end, and seeking judicial proceedings is usually recommended.

Should judicial proceedings be necessary, the owner, as lessor, is required to prove ownership of the aircraft and the valid termination of the lease. After obtaining a court judgment, a court decision is necessary to enforce possession. Generally, original documents must be presented both before and subsequent to the judgment.

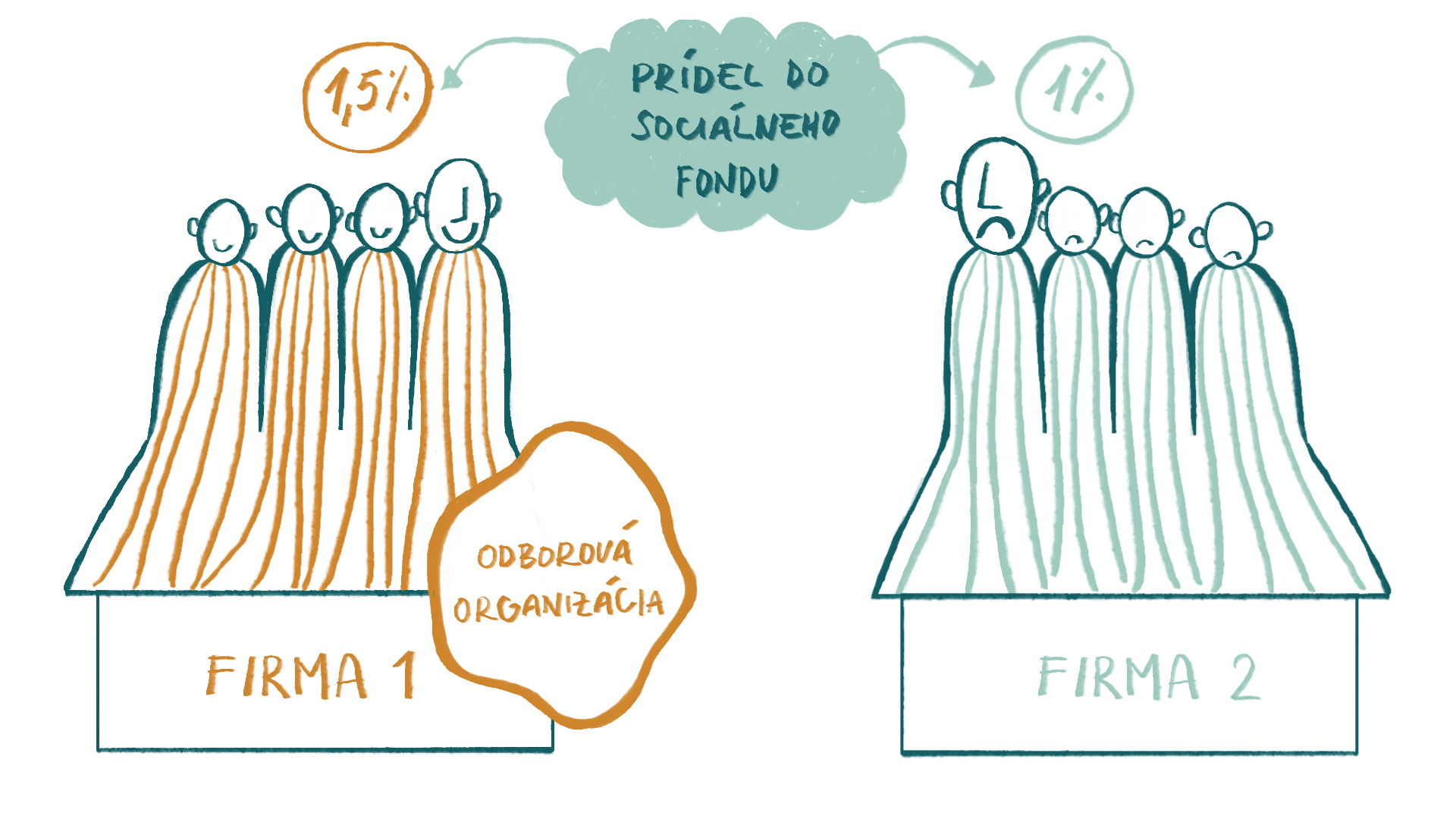

In Slovakia, there are no stamp duties, notarial fees, or other equivalent charges applicable in respect to the execution of an aircraft lease, a de-registration power of attorney, or any other lease-related documents concerning the aircraft. This also applies when such documents are executed and held outside of Slovakia. Consequently, there is no need for any form of consent, authorization, or license to exempt these transactions from such taxes or duties, as no such fees or taxes are imposed in the first place. No export licenses or permits are required for the repossession of civil aviation aircraft.

Slovakia has not joined the 2001 Cape Town Convention, which aims to standardize transactions of movable property, especially aircraft, providing legal clarity and efficient repossession processes for its signatories. Despite the EU’s accession to the Convention in 2009, Slovak authorities have not acknowledged its implications, and its applicability is unrecognized by the civil aviation authorities. Consequently, for US parties, Slovakia’s non-participation could mean facing more complex legal procedures for aircraft leasing and financing.

However, with well-drafted lease agreements tailored to the Slovak legal environment and guidance from qualified Slovak legal advisors, concerns regarding leasing aircraft to Slovak operators can be effectively addressed.